FundYourFX vs MyForexFunds

When it comes to prop firms, we’ve conducted extensive reviews, and their rules can be quite a challenge to navigate. It’s like embarking on a quest to find a hidden treasure buried in the depths of their FAQs. The real confusion often hits you square in the face only after you’ve already signed up.

In this article, we’re here to provide some much-needed clarity. We highly value transparent rules when selecting a prop firm, and we want to make sure our readers understand the differences between FundYourFX and MyForexFunds before they jump into applying for a funded trading account. Sometimes, we come across downright peculiar and mind-boggling rules, and we believe it’s our duty to explain them to our readers so they can make informed decisions and avoid any potential regrets.

So, without further ado, let’s delve into the world of MyForexFunds. Get ready to navigate the intricacies of prop firm regulations with us!

Introduction to MyForexFunds

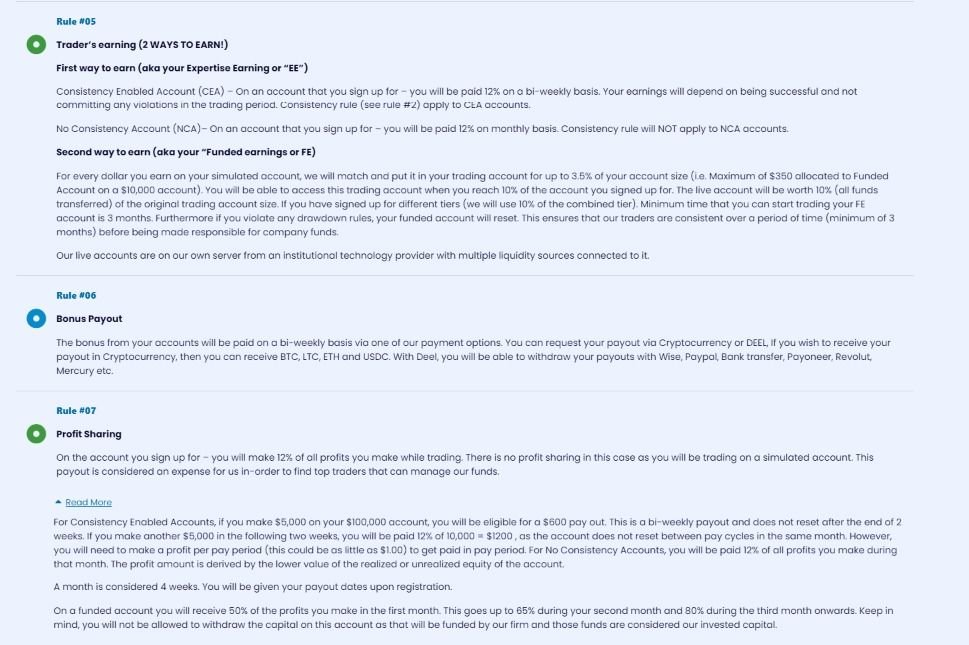

The prop firm started in 2020 and offered demo challenge and instant funding accounts. Like our previous comparison between FundYourFX vs The 5%ers, we talked about The 5%ers demo account. MyForexFunds has 3 different plans. The Rapid account is a demo account without challenge, but you will only make 12% of all profits. There is 2 ways to earn on this account, so let us break it down for you.

There are two account options: the Consistency Enabled Account (CEA) and the No Consistency Account (NCA). With the CEA, you’ll receive 12% payments on a bi-weekly basis. Your earnings depend on your trading success and following the trading rules. The consistency rule applies to CEA accounts. On the other hand, the NCA offers the same 12% payments, but on a monthly basis. There’s no need to worry about meeting consistency rules with NCA accounts.

There’s also a second way to earn called Funded Earnings (FE). For every dollar you earn in your simulated account, they’ll match it and transfer it to your trading account, up to 3.5% of your account size (maximum $350 for a $10,000 account). You can access the trading account once you reach 10% of your signed-up account size. Remember that you need to wait at least 3 months before trading your FE account. If you violate any drawdown rules, your funded account will be reset to ensure consistency over a minimum of 3 months.

The Evaluation account follows a two-step process. You can choose an account size ranging from $5k to $300k. In the first month, profit-split payouts occur once a month, and then they switch to a bi-weekly schedule. Here’s the catch: while you can accumulate up to $600k in capital from evaluation accounts, each trading account is limited to a maximum of $300k. The profit split is 75-85%. After the first month, you receive 75% of your profit. In the second month, it increases to 80% and continues to be paid bi-weekly. You get 85% of your profit bi-weekly from the third month onwards.

Last is their instant funding account called Accelerated. This has two different types, the Conventional and Emphatic. Traders on My Forex Funds’ Accelerated Accounts receive 50% of all profits. Payouts can be requested in two ways: either by being selected as the top trader of the day/week or by making weekly withdrawal requests.

Introduction to FundYourFX

FundYourFX and MyForexFunds are two prop firms worth discussing. FundYourFX was established in 2021, making it slightly newer than MyForexFunds. Rest assured, both firms are legitimate and operate within the bounds of the law. We’ve observed numerous traders successfully receiving payouts from both prop firms, which speaks to their credibility.

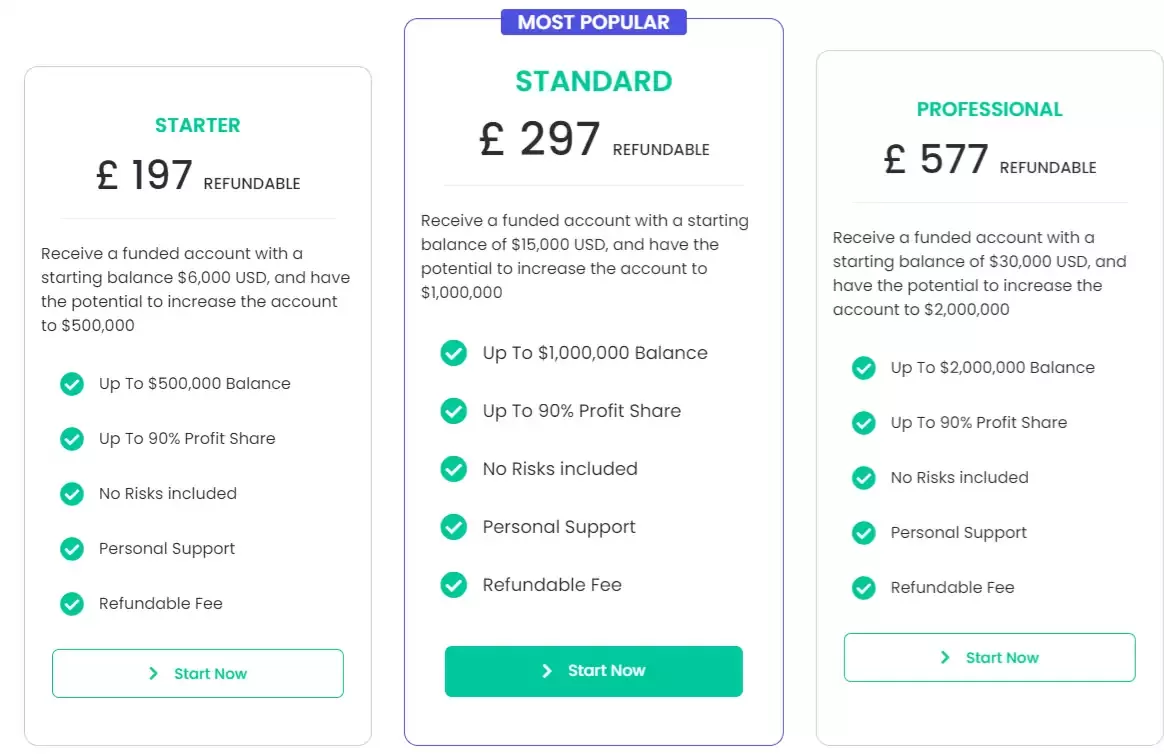

FundYourFX has recently introduced an new pricing plan, featuring three distinct funding options: Starter, Standard, and Professional. These plans offer varying benefits and features tailored to different trader preferences. We’ll delve deeper into these details shortly, so stay tuned for a comprehensive breakdown.

The Funded Trader Programs

A lot of prop firms are promoting instant funding now rather than challenges. Challenges can get difficult to pass, and you would lose your registration fee when you fail. Regarding a challenge account, MyForexFunds has its Rapid account.

So here’s the deal: when you sign up for an account, you’ll be making 12% of all the profits you generate while trading.

Now, let’s talk about Consistency Enabled Accounts. If you make $5,000 on your $100,000 account, you’ll be eligible for a $600 payout. This payout occurs on a bi-weekly basis and doesn’t reset after the end of two weeks. So, if you make another $5,000 in the following two weeks, you’ll be paid 12% of $10,000, which amounts to $1,200. You need to generate a profit per pay period, even if it’s as little as $1.00, to receive a payment within that period.

For No Consistency Accounts, you’ll receive 12% of all the profits you make during the month. The profit amount is determined based on the lower value of the account’s realized or unrealized equity.

Just to clarify, a month is considered four weeks, and you’ll receive specific payout dates upon registration.

When it comes to funded accounts, things work a bit differently. You’ll receive 50% of your profits in the first month, increasing to 65% during your second month. You’ll receive 80% of the profits from the third month onwards. However, it’s important to note that you won’t be allowed to withdraw the capital on this account, as their firm funds it, and those funds are considered their invested capital.

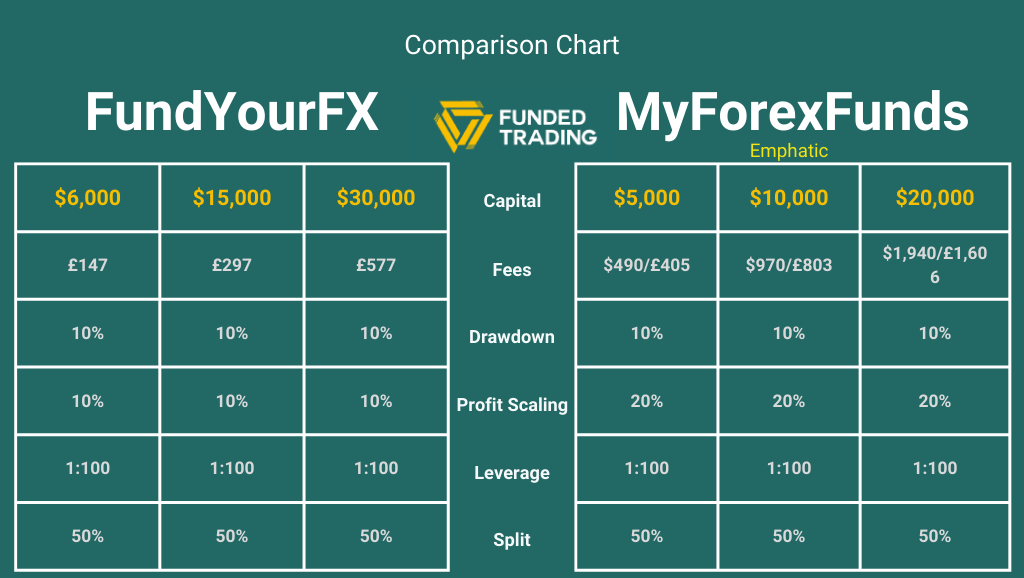

For the Accelerated account, they have the Conventional and Emphatic. To compare this with FundYourFX, it would be the Emphatic account, where both have the same 10% overall drawdown and 1:100 leverage.

As you can see, the overall drawdown in Conventional is only 5%, and leverage is 1:50. But the profit target to scale is the same as FundYourFX at 10%. If you combine the best rules of Conventional with Emphatic, you get an account similar to FundYourFX.

The Instant Funding Program

There are now three additional programs available to choose from at FundYourFX. The Starter program is the initial choice and cost the least. This would be ideal for novice traders who want to get their trading careers off to a good start with adequate cash but at a cheaper cost. After purchasing this program, you will receive $6,000 in actual capital, which costs £197.

They also included other new features, such as the fee being refundable. Your payment will be reimbursed after you have reached the target of 10% profit three times. Therefore, there is an advantage to trading for an extended period of time in FundYourFX.

The Professional program, which costs $£577 with $30,000 capital, may appeal to you if you are an experienced trader and feel confident about your trading abilities. If this describes you, the fact that you can recover your registration fee on your 5th payout makes the program more appealing.

Instant funding is also available with MyForexFunds. You are only given $10,000 in exchange for $485. If you do not own $485, you may acquire their capital of $2,000 by paying $99. It is a little bit more pricey.

The Differences

The price structure and trading guidelines are the primary areas in which FundYourFX and MyForexFunds differ. The Conventional is inexpensive, but it has a 5% total drawdown. If you want anything greater, such as 10%, you’ll have to shell out more money and get the more expensive program, the Emphatic. If the value of $10,000 in capital is $485 in Conventional, then in Emphatic, it is $970. When compared to FundYourFX’s pricing, that one is significantly more expensive. Because of how far apart they are, we can’t compare the two.

The Similarities

In addition, there are not very many similarities. FundYourFX profit split starts at 50% but can increase to 90%, whereas MyForexFunds maxed out at 50% for their instant funding. In all honesty, we cannot make a valid comparison between FundYourFX and the Conventional or the Emphatic. The drawdown for Conventional is only 5%, compared to 10% for FundYourFX. Conventional’s profit target is 10%, similar to FundYourFX. Emphatic offers a drawdown of 10%, but the profit objective is 25%, whereas FundYourFX’s profit target is just 10%. Therefore, the deal made by FundYourFX is far superior to any other program we examined and compared it to.

Summary

The pricing at MyForexFunds is more expensive than that at FundYourFX, as was previously indicated. It doesn’t matter if it is Conventional or Emphatic; both are still priced higher than FundYourFX. You may examine both the regulations and the prices, and you will discover that FundYourFX offers you a far better bargain overall. Here is the summary for the Conventional plan, which is cheaper than the Emphatic.

As you can see, the Conventional plan loses out to FundYourFX even though the price is not too far apart. We converted the USD to Pounds to make it easier for you to compare the prices. MyForexFund’s Emphatic account fares no better.

Compared to FundYourFX, MyForexFunds is more well-known and famous, so if you value the name, then MyForexFunds can be a good choice. If you value the fees and the relaxed rules, then you can choose FundYourFX.