Automated Forex Trading

Programs for automated forex trading come with several benefits. It is intended to work without the trader present by searching the market for successful currency trades using either pre-set parameters or parameters that the user has coded into the system. This article will discuss some of the best automated forex trading strategies for our readers.

What is Automated Forex Trading?

The automated forex trading software is based on a program that examines currency price charts and other market activities over a multitude of timeframes. Currency pair trades that have the potential to generate a profit are located by the program by analyzing several indications, such as price movements, spread disparities, and news that may have an effect on the market.

To summarize, automatic trading software allows you to switch on your computer, launch the application, and then go about your business while it handles all the trading.

Types of Forex Trading Automation

There are two categories that may be applied to forex trading systems:

- Trading systems that are fully automated generate their own signals and execute trades on their own (openings and exits). You could also come across the term “forex auto trading robots” in reference to these programs. They make room for human involvement by allowing the user to define parameters like lot size, take profits, stop losses, and a variety of other risk-management criteria.

- Forex signal providers are considered to be part of partial systems. In order to provide recommendations for trades, they employ a predetermined set of guidelines together with relevant details that are obtained via technical analysis. The user, on the other hand, will be responsible for manually executing positions.

The Benefit of Automated Forex Trading

- When you use programs that automate your Forex trading, you are giving the software the responsibility of doing all of the heavy work for you. Without the assistance of trading robots, the process of assessing the fluctuating prices on the market may take several hours, if not even longer.

- One of the most significant benefits of automated forex trading tools is the ability to remove emotional and psychological factors from the trading decision-making process and replace them with a rational, analytical perspective on the market. It’s possible for novice traders and even more experienced ones to make a trading decision based on some psychological trigger that goes against the logic of the current market conditions. These all-too-human errors in judgment simply do not happen when trading is done through automated systems.

Arbitrage Trading Strategy

Arbitrage is a type of trading strategy in which an investor simultaneously buys and sells an asset in a number of different marketplaces to create a profit by capitalizing on a disparity in the asset’s prices. The profits can be significant when compounded by a huge volume, although variations in price are often few and only last for a short period.

Although it has a very minimal level of risk, this strategy is in no way simple to execute. Finding the most lucrative opportunities to exploit in one’s trading attempts can be time-consuming for traders who employ this method. Because of this, traders are frequently needed to make use of a variety of trading robots and other programs to ensure that they are not passing up significant opportunities in the market.

Many people believe that forex arbitrage is one of the best algorithmic trading techniques for Forex due to the fact that it requires a significant amount of help from robots in order to get optimal results. You will have a much simpler time locating the best opportunities in the market if you use Forex robots instead of doing so on your own since these robots will perform all the legwork for you.

Trend Trading Strategy

The trend-based strategy is the most commonly adopted in. automated Forex trading. The simplest way to achieve this is to utilize technical indicators, but for retail traders who are analyzing on their own, it might be difficult to keep track of so many changes in such a short period of time. On the other hand, several forex robots on the market may assist traders with their technical analysis.

Once you’ve detected market trends, developed a trading strategy, and configured your automated trading robot, the robot will be able to meticulously follow your orders. In this manner, you can be certain that there are no emotions engaged in the transaction and that everything is carried out as designed.

News Trading Strategy

Trading based on the news and market expectations before and after the news publication is part of a trading strategy known as “news trading.” Due to the fact that it has the potential to influence the market, the news is an important component of trading. When breaking news occurs, particularly important news that everyone is paying attention to, you can almost always anticipate strong market activity. The fact that you are aware of the likelihood that the market may move demonstrates that this is an opportunity that should be pursued.

One of the best features of today’s trading robots is that in addition to analyzing the fundamental aspects of the market, they can also be used to examine the technical aspects of the market. Specialized Forex calendars are being used by a lot of individuals all around the world to ensure that they are keeping up with the continuous changes that are occurring in the market. Because of this, they are constantly in a position to be prepared for particular events that have the potential to have an impact on the Forex trading market.

Scalping Strategy

A trading strategy known as “scalping” aims to generate a profit from a succession of very small price movements. The goal of those who engage in scalping is to make a quick profit on each transaction in the expectation that these quick earnings will add up over time.

Scalping is a type of trading strategy that focuses on short-term price fluctuations and is particularly common among forex traders.

Although it offers a great deal of financial profit, traders must put in a lot of effort and pay a lot of attention to the market. Because of this, before determining whether to go short or long, you will need to wait for market conditions to supply you with indicators. Scalpers in forex typically trade using extremely short time frames, such as 1-minute, 5-minute, and 15-minute charts during day trading. If you are scalping, it is quite possible that you will open and close a large number of positions over the course of the trading day. Traders that employ such tactics for the short term sometimes rely on automated systems to do extremely rapid market analysis.

Which strategy is best for automated forex trading?

Finding the ideal automated trading strategy for Forex trading that caters to your individual requirements and preferences in the trading market is one of the most crucial things to do in order to achieve success with automated trading.

Those who use trading robots have access to a large number of different trading strategies; however, not every single one of these methods is equally successful and beneficial.

Before choosing a trading strategy to use in the forex market, it is necessary for you as a trader to first have a solid understanding of the requirements you have in this market. Backtesting is one of the most effective ways to choose a strategy since it allows one to observe the performance of the approach under various market situations.

Free Automated Forex Trading Software

People have a strong reason to be suspicious of free offers and discounts that seem too good to be true. The issue, on the other hand, is a little bit more complicated when automated trading systems for forex are involved. It goes without saying that there are no assurances that high-priced alternatives will perform better than free auto trading programs. However, you don’t have to worry about those issues for our free Funded Trading EA.

The most advantageous feature of our free Funded Trading EA is that it is sponsored by YourRoboTrader.com, which is the most reputable provider of robot trading software and which offers individualized, tailor-made trading strategies to traders of all experience levels. A team of industry professionals has put in a lot of effort to design a solution that will assist you in making money while minimizing the amount of risk involved.

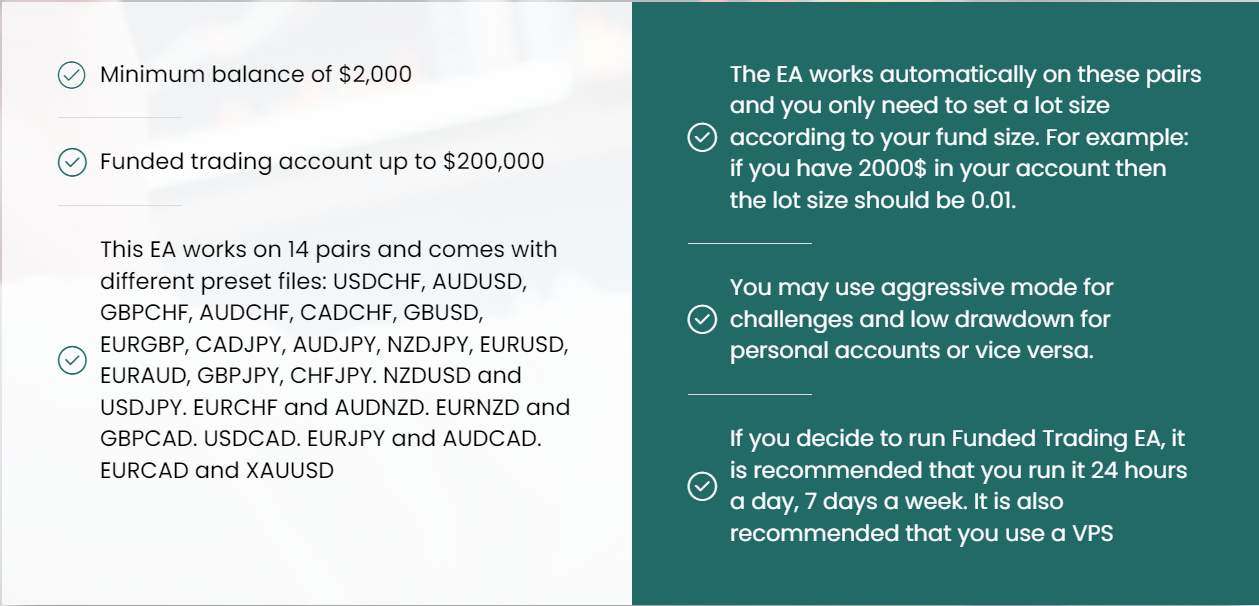

This Expert Advisor will provide you with the best forex signals based on a technical analysis of charts that reveal trends in the market price movements over time. These charts will be sent to you in order for the Expert Advisor to operate. These signals are developed by an algorithm that analyzes past data from the currency markets to help predict future price movements accurately. This enables traders to make educated decisions on when to purchase or sell particular assets during turbulent periods at the best prices for maximum profit margins without risking their own capital in any way. Here is a list of features for our EA: